Auto Deposit

Posted By admin On 26/07/22Quick – It's easy to receive your benefit by Direct Deposit. You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. With Autodeposit, consumers and businesses can make the process more efficient when receiving money: The recipient no longer needs to go into an email account to complete the deposit instructions for a transfer. This means the transaction is quick, and is directly deposited into the recipient’s account. Automatic Savings Plan: A type of personal savings system in which the plan contributor automatically deposits a fixed amount of funds at specified intervals into their investment account.

(redirected from Automatic Deposit)Use our online service to apply for or update direct deposit; OR. Print, fill out, and mail Form 710 Application for Electronic Deposit. Instructions and mailing address are included on the form. Call PBGC's Customer Contact Center to apply for or update direct deposit. Call at 1-800-400-7242.

Also found in: Financial.

direct deposit

n.direct′ depos′it

n.

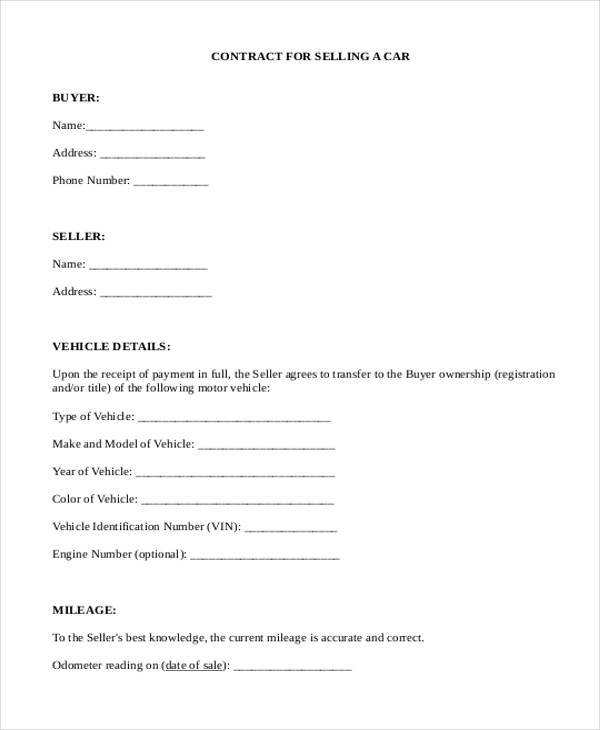

Non Refundable Deposit Auto Form

Want to thank TFD for its existence? Tell a friend about us, add a link to this page, or visit the webmaster's page for free fun content.Deposit For Car Sale Form

Link to this page:

Sending and receiving money is easier than ever with Interace-Transfer.

See how easy it is to send, receive and even request money electronically in Canada

Send Money Anytime

Want to send money to your child, landlord or a friend? Send an Interac e-Transfer anytime through RBC Online Banking or the RBC Mobile app. Easier than cheques and more secure than cash, Interac e-Transfer is free1 for RBC clients.

Simplify How You Receive Money

With Interac e-Transfer Autodeposit2, there’s no need to log into your Online Banking or answer a security question to receive an e-Transfer. Once you register your e-mail or mobile phone number, anytime someone sends you money, the funds will be automatically deposited into the specified account.

Request Money Owed to You

Need to ask a friend to pay you back for lunch? Ask them to send you an Interac e-Transfer using the Request Money3 feature. It’s a simple and fast way to send a friendly payback reminder.

Not Yet Enrolled in RBC Online Banking?

Enrol in 3 easy steps to get immediate access to your accounts and enjoy the ability to send, receive and request money using the Interac e-Transfer service.

Download the RBC Mobile app

With Siri for RBC Mobile, Sending Money Couldn't Be Easier

Enable Siri for RBC Mobile and see how easy it is to transfer money to anyone in your recipient list without even logging into the RBC Mobile app or signing into RBC Online Banking.

Learn More