Canara Bank Savings Account Interest Rate

Posted By admin On 02/08/22- Canara Bank Savings Account Interest Rates

- Canara Bank Savings Account Interest Rates 2020

- Canara Bank Interest Rates 2020

- Canara Bank Deposit Rates

- Canara Bank Online Account

- What Is The Interest Rate In Canara Bank

- Which Bank Has Best Savings Account Interest Rate

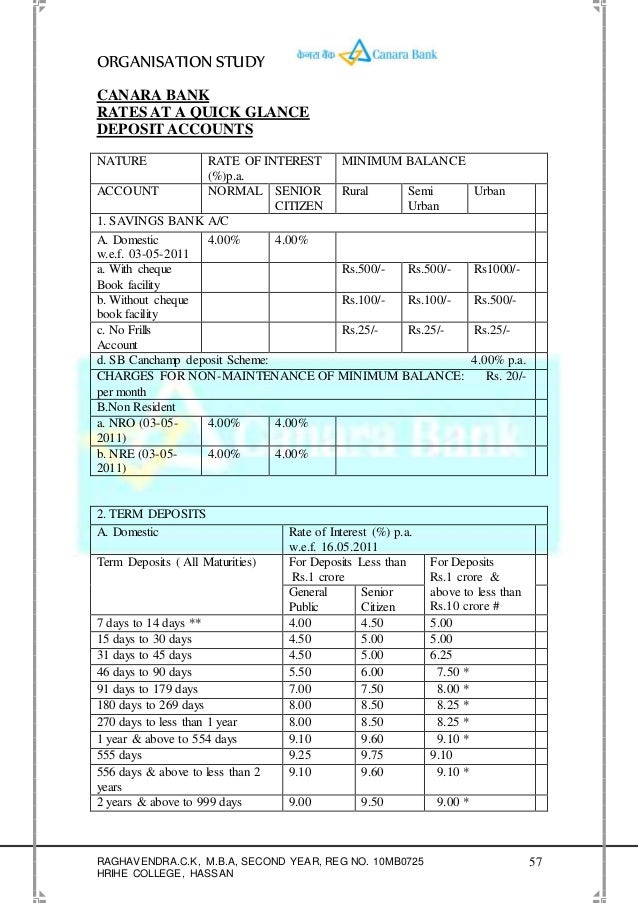

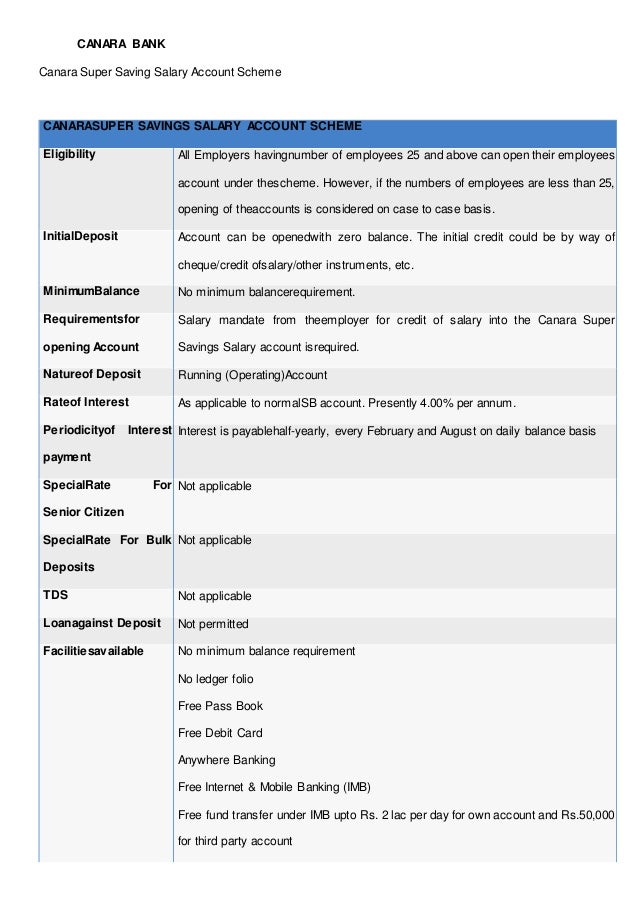

New Delhi, Sep 1 Public lender Canara Bank has reduced interest rate on savings bank accounts by 50 basis points to 3.5 per cent on deposits of up to Rs 50 lakh. However, the bank will continue to. INTEREST RATES DEPOSIT ACCOUNTS - RATES AT A QUICK GLANCE – as per RBI format. Canara Bank Savings Account Interest Rates & Minimum Balance So now let us move to the further part and check out more about the Canara Bank Savings Account. We have mentioned about the different types of savings accounts which are offered by this bank. The rate applicable is for the Canara Basic Savings Bank Account product that requires a minimum Rs.500/- minimum balance. The interest is payable half-yearly, every February and August on the daily balance maintained in the account. Canara Bank cuts interest rate on savings bank accounts On July 31, SBI slashed interest rate on savings account deposits by 50 basis points to 3.5 per cent on balance of Rs 1 crore and below.

Open Savings Account in Canara Bank : Canara Bank is one of the well known banks in India. If you do have an account in Canara Bank and you are planning to open a new savings account in Canara Bank, you are are the right place as we will guide you through the complete procedure. In order to proceed, you must be aware about the formalities, eligibility and steps to open a savings account in Canara Bank. If you know about all these steps, opening a savings bank account in Canara Bank will definitely be a piece of cake for you. Don’t forget to read our article on the procedure to link aadhaar card with Canara Bank Account.

Contents

- How to Open a Savings Bank Account in Canara Bank ?

How to Open a Savings Bank Account in Canara Bank ?

There are things you must know before knowing the complete procedure for opening Canara Bank Savings Account. Let us first know about the the Eligibility to Open Savings Account in Canara Bank.

Eligibility to Open a Savings Account in Canara Bank

Before visiting any Canara Bank Branch to open Canara Bank Savings Account, you must check whether you are eligible for the same or not. Here are the eligibility for opening Canara Bank Savings Account :

1) Applicant must be a Citizen of India.

2) Applicant must be more than 18 years of age (Except for Minor Account).

3) Applicant must possess the KYC Documents required to open Savings Account in Canara Bank. These documents are Address Proof, Identity Proof, PAN Card or Form 60/61.

4) In most cases, the applicant would need a Guarantor who has a Bank Account with Canara Bank.

5) Applicant will need to deposit minimum balance amount needed for the Savings Account(In some types accounts, like Jan Dhan Account this amount is not required).

At any point of time you can also prefer transferring Canara Bank Account or you can change Canara Bank Account Address. If you have not been using your Account from long time, it might be dormant and you can easily reactivate Canara Bank Dormant Account.

Steps to Open a Savings Account in Canara Bank

Once you know you are eligible to open a Canara Bank Savings Account, you must follow the below mentioned steps to open a Savings Account in Canara Bank.

1)Gathering the Documents : Your first step should be gathering all the KYC documents required for opening a Bank Account in Canara Bank. So, do keep Proof of Address, Proof of Identity, PAN Card and at least 2 passport size photographs with you. You may also be asked to show the originals of the same.

2)Filling up Account Opening Form : Once you have all the documents you can visit any Canara Bank Branch, collect the Canara Bank Savings Account Opening Form and fill it up completely. If you have any issues while filling up the form, you can take help of fellow people in the Bank or Canara Bank Officials.

Canara Bank Savings Account Interest Rates

3)Visit the Canara Bank Account Opening Branch : After you have filled up the Canara Bank Account Opening Form, do visit the Canara Bank Branch where you want to open your Savings Account. Do carry your filled up form and the documents mentioned above.

4)Verify your Form & Documents : Meet the Accounts Executive and ask him to verify your documents and form for opening a new Savings Account with Canara Bank. Upon verification and successful validation of your documents and form, you can go to the next step.

5)Deposit theMinimum Deposit Amount : After verification, move to the cash deposit counter and deposit the minimum deposit amount for your new bank account. In order to do so, please take a Cash Deposit Voucher/Slip and write ‘New Account’ in place where you need to write your Name and fill up the minimum deposit amount in Numbers and Words. Please confirm the Amount from the Cashier or Accounts Executive and deposit the form and cash voucher.

6)Collect Canara Bank Passbook and ATM/Debit Card : Once you have deposited the minimum deposit amount for your new savings account, you will be handed over your ATM Cum Debit Card and other Bank Documents. If you do not get the documents instantly, you may get them in 1-2 working days. If you need a custom Debit Card with your Full Name on it, you need to apply for it separately.

Note : If you have also applied for other facilities like Cheque Book and/or Net Banking, within few days you will get them at your address registered with Canara Bank. If you wish to change Mobile Number in Canara Bank, you can do it anytime.

Best Practices after getting a Savings Bank Account in Canara Bank

Once you have a Savings Bank Account with Canara Bank, you must keep a few things in mind :

1) Its always good to memorize your Bank Details including your PINs and Passwords so that you don’t always have to rely on the physical documents every time you need that information.

2) To be on a safer side, note down your Account Number, ATM Card no., PIN etc at a location which is secure enough.

3) Always keep Canara Bank Customer Care Number stored in your mobile phone’s contact list.

4) Don’t hesitate to contact Canara Bank customer care if you have lost your Canara Bank ATM card or in case of any other mishap related to your Account. If by any chance your account information or a cheque of your Account has fallen into wrong hands, you must immediately make a call to Canara Bank Customer Care or visit your Canara Bank Home Branch in order to block a particular service or your Savings Account to prevent any kind of unauthorized use.

Things to Know before you Open a Savings Account in Canara Bank

Before you plan to open a Savings Account with Canara Bank, you must know a few important things. There are a few queries which you must clarify by visiting any Canara Bank Branch or Calling Customer Care Number :

- Is there a Minimum Average Balance per month for maintaining this type of Savings Account in Canara Bank ? If yes, what is it? What types of fees do I have to pay if I go below that limit?

- What is the rate of interest which I will be getting on my Canara Bank Savings Account? How often is this interest generated ?

- Do I have any limit to the number of transactions every month ?

- Where can I withdraw cash using my ATM/Passbook/Cheques without paying any extra fees ? What is the extra amount charged for using other than Canara Bank ATM ?

Customer Care Numbers of Canara Bank

If you are looking for any kind of help from Canara Bank Customer Care, feel free to reach them on the Toll Free Number mentioned below.

Toll Free Number : 1800-425-0018

As you know that a Fixed Deposit (FD) is an investment option offered by banks that gives you higher rate of interest than a regular savings account. By investing in an FD, you can achieve your financial goals comfortably due to higher returns offered by it.

Canara Bank FD provides an option to deposit lump sum amount for a specific period, ranging from 7 days to 10 years. You can choose any of the tenures offered by Canara Bank FD according to your convenience and financial objective. As soon as you select the tenure and deposit the amount in Canara Bank_ FD, it will start earning an interest based on the tenure of the deposit. Customer is allowed to deposit lump sum money into a fixed deposit only once into his FD account at the time of opening the account with the bank and afterwards he cannot deposit additional money in the same FD account.

You can also get tax benefits under section 80C of the Income Tax Act on an amount between Rs. 100 to 1.5 lakh by investing in Canara Bank FD for a tenure of 5 years or more.

Following table provides you Canara Bank FD Rates of various tenors. Also, given below is the facility/ option, through which you can calculate the interest rate and the maturity value of your Canara Bank FD for different tenures by clicking on the 'calculate' button provided in the table.

Canara Bank Fixed Deposit Interest Rates (as on 06 Mar 2021)

| Maturity Period | Interest Rate (p.a.) | Calculate Interest Rate |

|---|---|---|

| 30 Days | 3.00% | |

| 45 Days | 3.00% | |

| 60 Days | 4.00% | |

| 90 Days | 4.00% | |

| 120 Days | 4.05% | |

| 6 Months | 4.50% | |

| 9 Months | 4.50% | |

| 12 Months | 5.40% | |

| 2 Years | 5.35% | |

| 3 Years | 5.30% | |

| 4 Years | 5.30% | |

| 5 Years | 5.30% | |

| 10 Years | 5.30% |

Features & Benefits: Canara Bank Fixed Deposit

- Competitive interest rates are offered with flexible FD tenures to suit your investment plan.

- FD account can be opened online or by visiting your nearest Canara Bank branch.

- No cap on the Maximum Amount of FD

- FD Tenures: 7 days to 10 years

- Different interest payout options such as monthly, quarterly, etc.

- Loan/ Overdraft against FD facility is available upto 85% of the FD amount.

- Easy and fast liquidity options are available.

- Nomination facility is available.

- Tax benefit of amount up to Rs 1,50,000, through tax saving term deposit scheme

- Part withdrawal facility and auto-renewal facilities are also available

- Senior citizens can enjoy higher interest rate as compared to regular citizens

- NRE, NRO and FCNR deposit facility is offered by the bank

Who is Eligible for Canara Bank Fixed Deposit

Canara Bank Savings Account Interest Rates 2020

Any of the following persons is eligible to invest in fixed deposits (FD):

- Individual

- Minor

- HUF

- Proprietary Firm

- Partnership Firm

- Limited Liability Partnership (LLP)

- Company

- Association of Persons (AOP)

- Body of Individuals (BOI)

- Local Authority

- Trust

- Non-Resident Indian (NRI)

- Registered Society

Important Things to Know Before Investing in Fixed Deposits

- Always compare tenure-wise FD interest rates of different banks before finalizing the bank for opening an FD account, in order to get maximum interest rate on selected tenure.

- The tenure for most bank fixed deposits varies from 7 days to 10 years. You should choose the FD Tenure according to your convenience and objective behind investment.

- Opt for interest payout options such as monthly or quarterly, if required. Otherwise, choose cumulative option so that you can receive lump sum amount when FD gets matured.

- You can also avail loan or overdraft against FD, if you have immediate requirement of funds.

- If your annual income is non-taxable, you can submit Form 15G or Form 15H in order to avoid TDS.

- Don't forget to make nomination in your FD account.

- If you are a senior citizen then open your FD in a bank which offers extra interest of 0.25% to 0.75% to senior citizens.

- When you open fixed deposit online or offline, do not forget to give instructions on what to do on maturity of your FD. If you do not give any instruction, your fixed deposit will be renewed automatically on maturity.

Calculation of Interest on FD of Canara Bank

Interest on FD for different tenures is calculated in following manner:

- Simple interest is paid at maturity for fixed deposit tenure of less than 6 months.

- Interest is calculated on a quarterly basis for fixed deposit tenure of 6 months & above.

- Cumulative Interest/ re-investment interest is calculated every quarter, and is added to the Principal such that Interest is paid on the Interest earned in the previous quarter as well.

- In case of monthly deposit scheme, the interest shall be calculated for the quarter and paid monthly at discounted rate over the Standard FD Rate

Canara Bank FD Interest Calculator

Canara Bank FD Interest Calculator is an online financial tool that allows you to calculate the maturity value of your fixed deposit at the interest rate offered by bank. The amount of FD, interest rate, deposit tenure and compounding frequency of interest together determine the maturity amount of the FD at the end of the tenure.

Canara Bank Interest Rates 2020

Automatic Renewal of Bank FD

Bank FD matures on specific date. On maturity, if you have not given any specific instructions such as payout or renewal of FD, most of the banks automatically renew the FD for the same period for which it was initially made at the interest rate prevailing on the date of maturity of FD. This is called Automatic Renewal of Bank FD.

You should choose the option on the account opening form, if you do not want the bank to auto renew your FD. You have 2 options on the account opening form while depositing money in FD, first one is auto renew and second one is deposit of amount to your account after maturity. In case you have not mentioned any option on the account opening form then you will need to visit the bank branch on maturity day of your bank FD and opt for credit of the final proceeds of your bank FD into your savings account if you do not want an auto renewal of your FD.

Bank FD News Mar 2021

Canara Bank Deposit Rates

13-01-2020: SBI revised FD interest rate

SBI has announced a cut in retail fixed deposits of FD rates. The latest FD rates on SBI deposits is effective from 10th January 2020. The bank has cut the FD rates by 15 bps on long-term deposits maturing in 1 year to 10 years. Now FD interest rate for 7 to 45 days is 4.50%, for 46 to 179 days is 5.50%, for 180 days to 1 year is 5.80% and for 1 year to 10 years is 6.10%.

09-01-2020: Axis Bank reduced FD interest rate

Axis Bank reduced interest rates by up to 20 bps from January 9. FDs for less than Rs 2 crore and with the tenor of less than 1 year will earn 6.40%, for the tenor of 5 years to up to 10 years, FD rates is 6.50%.

07-01-2020: HDFC Bank deposits up by 25% (YoY) in 2019

The largest private sector lender HDFC Bank's deposits up by 25% (YoY) in 2019. Its deposits are at Rs 10.67 trillion as of December 31, 2019 growing by 25% as compared to Rs 8.52 trillion as of December 31, 2018..

24-12-2019: HDFC Bank revised FD interest rate

Canara Bank Online Account

The revised rate for FDs maturing in 9 months 1 day to less than 1 year will be 6.05%. Term deposits maturing in 1 year to 2 years will fetch an interest rate of 6.3%, 2-3 years 6.40%, and 3 years to 10 years 6.3%.

01-12-2019: PNB cuts off FD rates

What Is The Interest Rate In Canara Bank

With effect from December 1, 2019, FDs for less than Rs 2 crore and the tenor of 271 days to below 1 year will be 6% for general customers and 6.5% for senior citizens. For the tenor of 5 years to up to 10 years, PNB has FD rates of 6.3% for general customers and 6.8% for senior citizens.

12-11-2019: ICICI Bank reduces FD interest rate

The interest rates on ICICI Bank FD for less than Rs 2 crore and the tenor of 185 days to 289 days will be 5.75%, for 5 years to up to 10 years will be 6.40% and 6.9% for senior citizens. Its interest rates will be effective from December 7, 2019.

Public Sector Banks FD Interest Rates

Which Bank Has Best Savings Account Interest Rate

| Allahabad Bank | Andhra Bank | Bank Of Baroda |

| Bank Of India | Bank Of Maharashtra | Canara Bank |

| Central Bank Of India | Corporation Bank | Idbi Bank |

| Indian Bank | Indian Overseas Bank | Oriental Bank Of Commerce |

| Punjab National Bank | Syndicate Bank | Uco Bank |

| Union Bank Of India | United Bank Of India | Vijaya Bank |

| State Bank Of India | State Bank Of Mysore | State Bank Of Patiala |

| State Bank Of Travancore | State Bank Of Bikaner And Jaipur | Punjab And Sind Bank |

Private Sector Banks FD Interest Rates

| Axis Bank | Bandhan Bank Limited | Catholic Syrian Bank Limited |

| City Union Bank Limited | Dcb Bank Limited | Dhanalakshmi Bank |

| Federal Bank | Hdfc Bank | Icici Bank Limited |

| Idfc Bank Limited | Jammu And Kashmir Bank Limited | Indusind Bank |

| Karnataka Bank Limited | Karur Vysya Bank | Kotak Mahindra Bank Limited |

| Laxmi Vilas Bank | The Nainital Bank Limited | Rbl Bank Limited |

| South Indian Bank | Tamilnad Mercantile Bank Limited | Yes Bank |

| Equitas Small Finance Bank Limited | Ujjivan Small Finance Bank Limited | Utkarsh Small Finance Bank |

| Suryoday Small Finance Bank | Au Small Finance Bank Limited | Capital Small Finance Bank Limited |

| Esaf Small Finance Bank Limited | North East Small Finance Bank Limited | Fincare Small Finance Bank Ltd |