Chase Savings Account Interest

Posted By admin On 23/07/22Yes, interest earned on a checking or savings account deposit is considered as income and is taxable under the regular brackets. Get 5% Cash Back on 5 Brands of Your Choice OnJuno Debit Card rewards you like a credit card without the high fees and debt. High-yield savings accounts help you earn a higher yield than a typical savings account. The national average savings account annual percentage yield (APY) is just around 0.07 percent APY.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

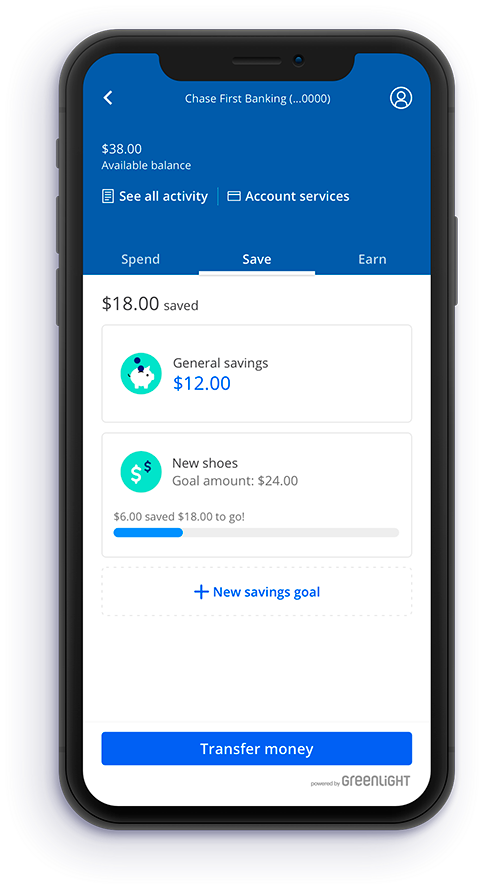

Savings made simple with Chase Savings℠

This account makes it easy to start saving. You’ll have access to chase.com and our mobile banking tools.

Benefits of Chase Savings℠

- Earns interest. See interest rates.

- Automatic Savings Program

- Online and mobile banking

- Account Alerts

- Access to 16,000 ATMs and more than 4,700 branches

- FDIC insurance protection

Account details include:

- $5 monthly service fee or $0 with one of the following, each monthly statement period:

- A balance at the beginning of each day of $300 or more in this account

- OR $25 or more in total Autosave or other repeating automatic transfers from your personal Chase checking account (available only through chase.com or Chase Mobile®)

- OR a Chase College Checking℠ account linked to this account for Overdraft Protection

- OR an account owner who is an individual younger than 18

- OR a linked Chase Better Banking® Checking, Chase Premier Checking℠, Chase Premier Plus Checking℠, Chase Sapphire℠ Checking, or Chase Private Client Checking℠ account

Savings Withdrawal Limit Fee: $5 Savings Withdrawal Limit Fee, which is a Chase fee, applies to each withdrawal or transfer out of this account over six per monthly statement period. All withdrawals and transfers out of this account count toward this fee, including those made at a branch or at an ATM.

Other miscellaneous fees apply.

See Account Disclosures and Rates for more information. Account subject to approval.

BeginningTools to help you bank on your terms.

Direct Deposit

Most convenient way to automatically deposit your checks each payday.

Chase QuickDeposit℠

Just point and click to deposit checks from almost anywhere, anytime.

Online Bill Pay

Make payments securely at chase.com or with your mobile device.

Chase QuickPay® with Zelle®

Easily send money to another person without cash or checks.

Paperless Statements

Access up to 7 years of statements online or on your mobile device.

Account Alerts

Monitor your finances to help avoid overdrafts and safeguard your account.

Text Banking

Check balances and transaction history on the go by simply sending a text.

EndFind the right savings account for you

- Chase Certificates of Deposit

- Chase Premier Savings℠

Find a Chase ATM or branch

To find a Chase ATM or branch near you, tell us a ZIP code or an address.

Additional assistance

- See exclusive Chase Private Client products

- Learn about Chase Military Banking for servicemembers

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Open a Chase Certificate of Deposit

You must be an existing Chase checking customer to open online.

Certificate of Deposit FAQ

What is a Chase CD?

A certificate of deposit, or CD, is a deposit account with us for a specified period of time.

What is the minimum deposit amount to open a Chase CD?

$1,000

How is the Chase CD interest calculated?

We use the daily balance method to calculate interest on your CD. This method applies a periodic rate each day to your balance. Interest begins to accrue on the business day of your deposit. Interest for CDs is calculated on a 365-day basis, although some business CDs may calculate interest on a 360-day basis. The Annual Percentage Yield (APY) disclosed on your deposit receipt or on the maturity notice assumes interest will remain on deposit until maturity. On maturities of more than one year, interest will be paid at least annually. Please see the Deposit Account Agreement and rate sheet for further details.

Are there early withdrawal fees or penalties associated with a Chase CD?

There is a penalty for withdrawing principal prior to the maturity date. For Personal CDs:

- If the term of the CD is less than 6 months, the early withdrawal penalty is 90 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the term of the CD is 6 months to less than 24 months, then the early withdrawal penalty is 180 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- For terms 24 months or more, the early withdrawal penalty is 365 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the withdrawal occurs less than seven days after opening the CD or making another withdrawal of principal, the early withdrawal penalty will be calculated as described above, but it cannot be less than seven days’ interest.

- The amount of your penalty will be deducted from principal.

See the Deposit Account Agreement and rate sheet for further details

What does it mean when my Chase CD matures?

The maturity date is the last day of your CD’s term. The grace period begins the following day and lasts for 10 days – this is when you can make changes to your CD. Go to chase.com/cdmaturity to learn more about what options you have when your CD matures.

Find a Chase ATM or branch

To find a Chase ATM or branch near you, tell us a ZIP code or an address.

Chase Savings Account Interest Percentage

Open a Chase Certificate of Deposit

You must be an existing Chase checking customer to open online.

Open a CD account See rates and terms to fit your needs

Open a CD account See rates and terms to fit your needsCertificate of Deposit FAQ

What is a Chase CD?

A certificate of deposit, or CD, is a deposit account with us for a specified period of time.

What is the minimum deposit amount to open a Chase CD?

$1,000

How is the Chase CD interest calculated?

We use the daily balance method to calculate interest on your CD. This method applies a periodic rate each day to your balance. Interest begins to accrue on the business day of your deposit. Interest for CDs is calculated on a 365-day basis, although some business CDs may calculate interest on a 360-day basis. The Annual Percentage Yield (APY) disclosed on your deposit receipt or on the maturity notice assumes interest will remain on deposit until maturity. On maturities of more than one year, interest will be paid at least annually. Please see the Deposit Account Agreement and rate sheet for further details.

Are there early withdrawal fees or penalties associated with a Chase CD?

There is a penalty for withdrawing principal prior to the maturity date. For Personal CDs:

- If the term of the CD is less than 6 months, the early withdrawal penalty is 90 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the term of the CD is 6 months to less than 24 months, then the early withdrawal penalty is 180 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- For terms 24 months or more, the early withdrawal penalty is 365 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the withdrawal occurs less than seven days after opening the CD or making another withdrawal of principal, the early withdrawal penalty will be calculated as described above, but it cannot be less than seven days’ interest.

- The amount of your penalty will be deducted from principal.

See the Deposit Account Agreement and rate sheet for further details

What does it mean when my Chase CD matures?

Chase Savings Account Interest Rates

expandChase Savings Account Interest Rate Percentage

The maturity date is the last day of your CD’s term. The grace period begins the following day and lasts for 10 days – this is when you can make changes to your CD. Go to chase.com/cdmaturity to learn more about what options you have when your CD matures.

Chase Savings Account Interest Rate Today

Find a Chase ATM or branch

Chase Bank Interest Bearing Accounts

To find a Chase ATM or branch near you, tell us a ZIP code or an address.