Suntrust Cd Rates

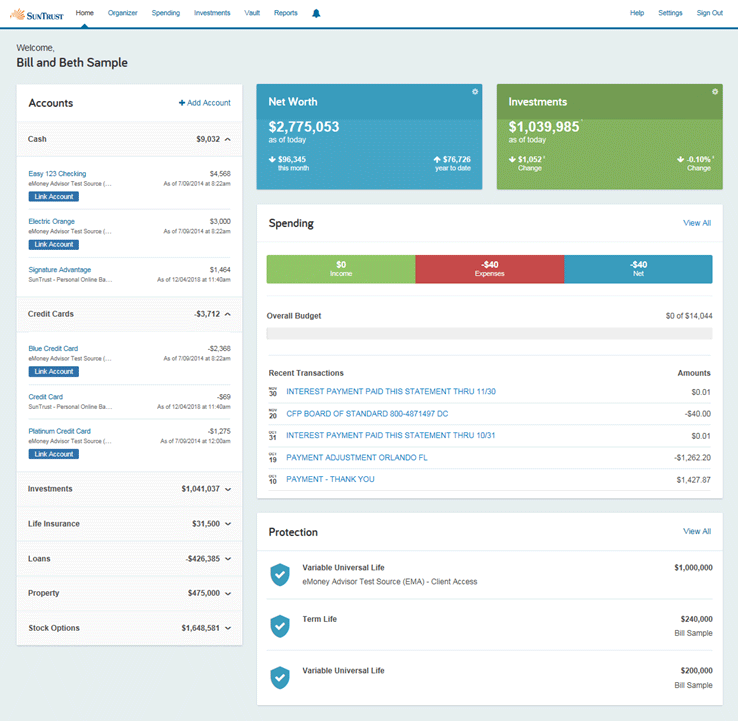

Posted By admin On 20/07/22Suntrust Bank has 1,400 branches in the Southeast region. Checking accounts require $100 to open and offers different ways to waive fees. Known as a regional bank with good customer service.

SunTrust Bank Promotions

Overview of SunTrust CDs. SunTrust offers a huge range of CD terms overall with the shortest term at six months and the longest available term at 2 years. However, you’ll want to focus most on the Promotional CDs listed above. Those have the best CD rates that SunTrust offers. For example, if you want to open a six-month account, you’ll. We review more than 150 banks and credit unions each weekday to find the best certificates of deposit (CD) rates available nationwide. The top picks have the highest rates for a particular term based on annual percentage yield (APY) and are available to the public.

From time to time, SunTrust Bank offers cash bonuses for new banking customers. Some deals are only available for residents of select States, so make sure you read the fine print carefully.

All SunTrust Bank checking accounts offer free online banking, bill pay, and mobile deposits. There are over 2,100 ATMS.

Special Checking Account Features

SunTrust checking accounts come with these features:

- Overdraft services. SunTrust offers a few options to help cover overdrafts. If you overdraw your account, but make a deposit to cover the amount by the cut-off time, you will not be charged any fees. Or you can enroll in Overdraft Protection and link a SunTrust savings, money market, credit card, or line of credit. Funds from those will be automatically transferred to cover any overdrafts. Enrollment in these services are optional.

- Free checks. All checking accounts come with free checks. The amount varies depending on which account you open.

- Cash deposit bonus. If you have a SunTrust Cash Rewards credit card, you will earn a bonus when you redeem your rewards back into a SunTrust deposit account. The bonus ranges from 10% - 25%, depending on which checking account you have.

- Send money with Zelle. Easily send money to anyone with just a U.S. phone number or U.S. email address.

What to Open at SunTrust Bank

- Promotional CDs. SunTrust Bank offers a great rate for their Promotional CDs of 12-month or longer. Terms go up to 58 months. The minimum to open is $2,000.

- Select Savings. This savings account allows you to earn a 1% annual bonus (up to $25) when linked with a Select Checking or Signature Advantage Checking account. You can avoid the monthly service fee by setting up auto transfers of at least $25/month from your checking account, or by maintaining a daily balance of at least $1,000.

- Essential Checking student account. If you're a student, you can get the Essential Checking for free for up to 5 years. You must be able to prove active enrollment in high school, college, or trade school.

How to Avoid Suntrust Bank Checking Account Fees

- Essential Checking. The $7 monthly fee can be waived if you: initiate 10 or more transactions per statement cycle, OR maintain a daily balance of at least $500, OR have combined direct deposits of at least $500 per month, OR open as a student and receive a 5-year Student waiver.

- Select Checking. The $15 monthly fee can be waived if you: maintain a daily balance of at least $2,000, OR have combined direct deposits of at least $2,000 per month, OR maintain a combined balance of at least $10,000 across all deposit accounts, investments, mortgages and loans, OR hold a SunTrust Mortgage with SurePay, OR hold a linked small business checking account.

- Signature Advantage Checking. The $20 monthly fee can be waived if you maintain a combined balance of at least $10,000 across all SunTrust deposit and investment accounts, make $3,000 or more in total monthly qualifying direct deposits, or hold a linked SunTrust Small Business Checking account, Lending account or Credit Card solution.

- Balanced Banking. The $12 monthly fee can be waived if you maintain a combined balance of at least $3,000 across all SunTrust deposit and IRA accounts.

[Update February 2021: SunTrust Bank’s fixed and variable rate deposit accounts including CDs, savings and money market accounts, have not seen a rate change yet this year.]

SunTrust Bank, now Truist, is a hybrid brick-and-mortar and online bank. Their branch locations are limited to a handful of Southeastern states, but their personal banking products can be managed 100% digitally – making this corporation accessible to just about anyone.

In 2019, BB&T and SunTrust merged to become Truist Financial Corporation. But today, the two banks still operate separately and offer a distinct set of products.

On the savings side of the equation, SunTrust’s FDIC-insured products include interest checking, savings accounts, money market accounts, and CDs.

But how do they stack up?

First off, if you value an in-person banking experience and don’t live in the Southeast, SunTrust likely isn’t for you. But if you do live near a branch and/or you’re ready to go digital then you could consider them as an option. Just don’t expect much in the way of savings rates at the moment.

All of SunTrust deposit and savings accounts are federally insured by the FDIC to the legal limit of $250,000

SunTrust Bank offers two savings account options:

- an Essential Savingsaccount and

- a Select Savings account.

SunTrust Essential Savings Account

A SunTrust Essential Savings account earns a pitiful rate of 0.01% APY. This almost makes the national average of 0.06% APY look less terrible than it really is.

Interest is compounded daily and credited quarterly. You need only maintain an average daily balance of $0.01 to avoid closure, so while there is technically a minimum balance requirement, access to this account isn’t restricted to wealthier individuals.

This account doesn’t require a minimum opening deposit either, and it also doesn’t charge any monthly maintenance fees. There is, however, an incentive to go paperless in the form of a $3 paper statement fee.

SunTrust Bank Select Savings Account

With a SunTrust Bank Select Savings account, you’ll be getting a slightly less basic account with a (sort of) better rate. The standard APY on this account is also 0.01%, but loyal customers can earn an annual bonus worth 1% APY of their balance up to $25. In other words, you can make up to $25 on top of whatever you’re earning from the paltry 0.01% APY.

A Select Savings account comes with a $7 monthly maintenance fee that can’t just be dodged by going green with billing, but it can be avoided in one of two ways:

- setting up automatic transfers totaling $25 or more per statement cycle

- or by maintaining an average daily balance of at least $1,000.

SunTrust Advantage Money Market Account

Finally, there are the SunTrust Advantage money market accounts. The national average rate on a money market is currently a measly 0.09%, so you might be surprised to find that right now, SunTrust Bank is paying only 0.01%. But this isn’t always the case—this bank often offers promotional introductory rates that are far better than this, but you’ll actually have to call customer support to inquire about offers in effect as rates vary by area and account history and aren’t posted or searchable.

And although rates aren’t currently listed, they are tiered rates calculated by balance. These are the balance tiers:

- Tier 1: <$9,999.99

- Tier 2: $10,000 – 24,999.99

- Tier 3: $25,000 – 49,999.99

- Tier 4: $50,000 – 99,999.99

- Tier 5: $100,000 – 249.999.99

- Tier 6: $250,000 – 499,999.99

- Tier 7: $500,000 – 999,999.99

- Tier 8: $1,000,000 – 1,999,999.99

- Tier 9: $2,000,000+

Interest on a money market account is compounded daily and credited monthly. A minimum balance of $10,000 is enforced through a $17 low balance fee. This can be avoided by either meeting the balance requirement or setting up an electronic transfer/deposit of at least $100. You will need to make a deposit of at least $100 upon account opening.

No matter what SunTrust savings account you have, you’ll be restricted to 6 transactions per account, per month—this, of course, is the government’s rule, not SunTrust’s. Transact more than this and you will incur a fee of $6 per transaction on an Essential or Select savings account and $15 per transaction on a money market savings account.

One final note on SunTrust Bank savings accounts, which may or may not make up for these lackluster rates, is that they make you eligible for a 10% loyalty cash bonus if you a) Have a SunTrust Rewards Credit Card and b) Redeem the cash bonus you get from this card into a deposit account (via ACH transfer). Essential, Select, and Advantage Money Market savings accounts count toward this bonus.

SunTrust Bank Advantage CD rates are similarly elusive, but you can search current promotional rates by area here. This is what we found for the vast majority of zip codes. If you found something different please leave us a comment on this post, or email us a screenshot of the rates you see.

SunTrust Bank CD Rates

To give the offers above some context, the current national average on a 12 month CD sits at just 0.27% APY currently. All SunTrust certificates do manage to come in slightly above this, however much better deposit rates can still be had elsewhere.

A minimum deposit of $2,000 is required to open an Advantage certificate account. In the fine print, you’ll see that SunTrust Bank requires you to have a checking accountwith them before they’ll let you open an Advantage CD.

Early withdrawal penalties are issued based on the amount of time you have left on a term, not the full length of the term upon issuance. The fees are as follows:

- If you have 1 to 31 days remaining, you’ll pay 180 days’ interest.

- If you have 1 to 6 months remaining, you’ll pay 270 days’ interest.

- If you have 12 to 24 months remaining, you’ll pay 360 days’ interest.

- If you have 24 to 60 months remaining, you’ll pay 720 days’ interest.

- And if you have more than 60 months remaining, you’ll pay 1080 days’ interest.

You can make ONE penalty-free withdrawal within 7 days of opening or renewing an account.

Both BB&T and SunTrust ATMs are available for SunTrust customers to use. This adds up to over 2,000 ATMs to use surcharge free. On top of that, SunTrust Bank has branch locations in the following states:

- Alabama,

- Arkansas,

- District of Columbia,

- Florida,

- Georgia,

- Maryland,

- Mississippi,

- North Carolina,

- South Carolina,

- Tennessee, and

- Virginia.

You will be refunded up to 3 times per statement cycle for transactions made using out-of-network ATMs.

SunTrust Bank scores about average in the customer banking experience department. The bank has received a fair amount of negative reviews recently, especially with regard to mortgages and personal loans, but has 3.5 stars overall out of 679 reviews on WalletHub. This is slightly better than average, but out of 169 reviews on ConsumerAffairs (which seems to be the place people go to complain), the bank has 1.1 stars.

Suntrust Cd Rates August 2020

In general, SunTrust Bank physical branch locations, good enough remote service, and easy set-up processes are sources of satisfaction for many. While unexpected account closures—a theme across many digital bank review forums—and merger complications are common complaints against the bank.

If you bank with SunTrust Bank, you can probably count on decent customer service over thephone, but if you live near a branch location, you’re likely to get better service there. To get intouch with customer support, call 1-(800)-786-8787 (hours not listed).

The SunTrust Bank app performs well with 4.4 stars on Google Play and 4.1 stars on the App Store. The bank’s mobile and online platforms are said to be easy-to-use and relatively glitch-free.

ACH Transfer Limitations:

SunTrust Bank limits external ACH inbound transfers to $10,000 per transaction and per day, and outbound ACH transfers to $2,000 per transaction and per day.

Yes, this bank has offered stellar APYs in the past, however with the savings rates offered today there is little to be excited about here.

Suntrust Cd Rates May 2020

This bank is going to be more for people that live in the Southeastern part of the country who prefer the option of walking into a branch to manage their accounts. This isn’t going to be a great fit for rate hounds, low-income individuals, or anyone looking to grow their money with FDIC-insured savings vehicles. Account options are limited, come with the potential for rather steep fees, and are generally at or below average in terms of rates.